Portfolio Details

FinMap – Your Universal Financial Control Hub

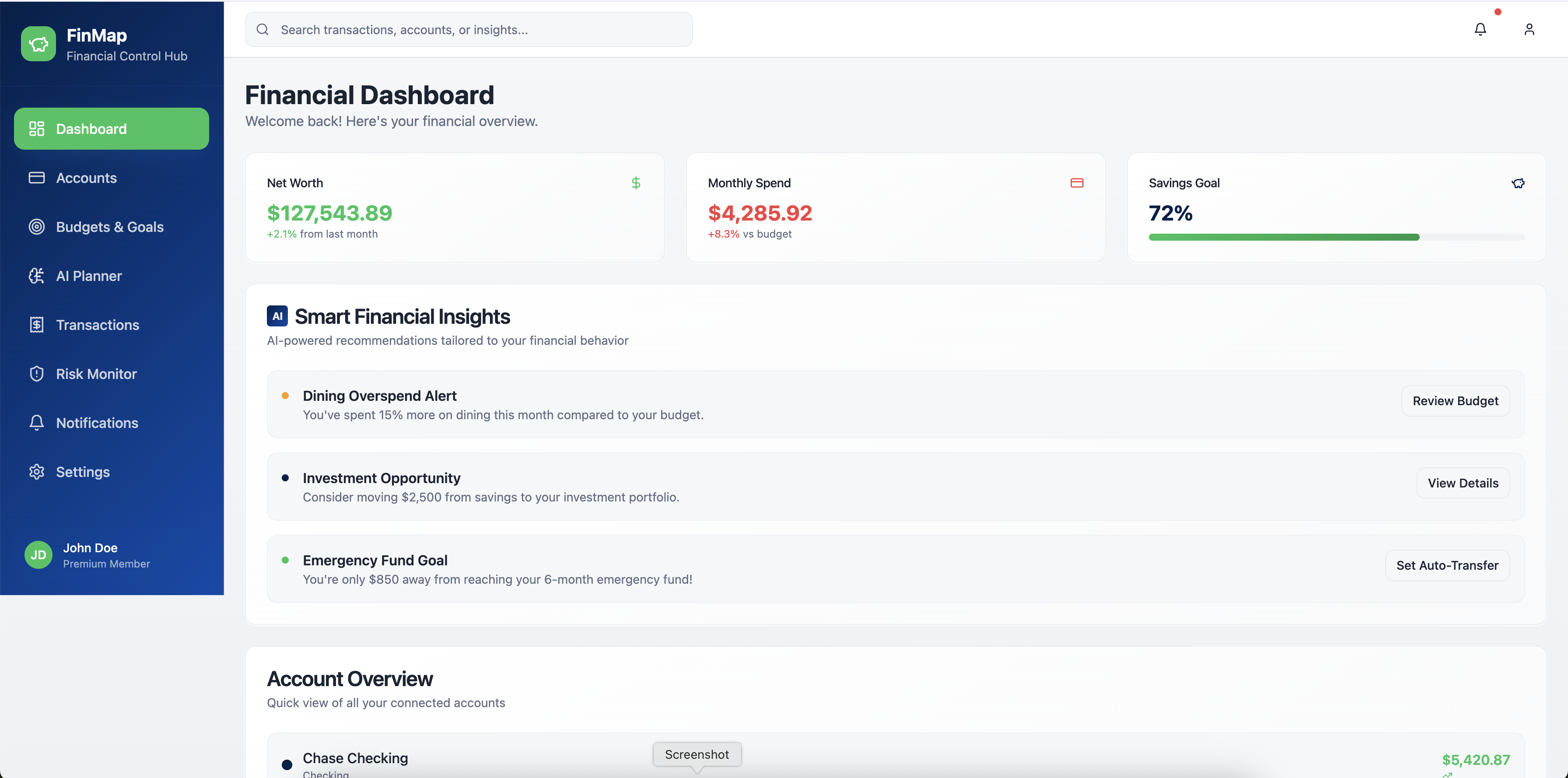

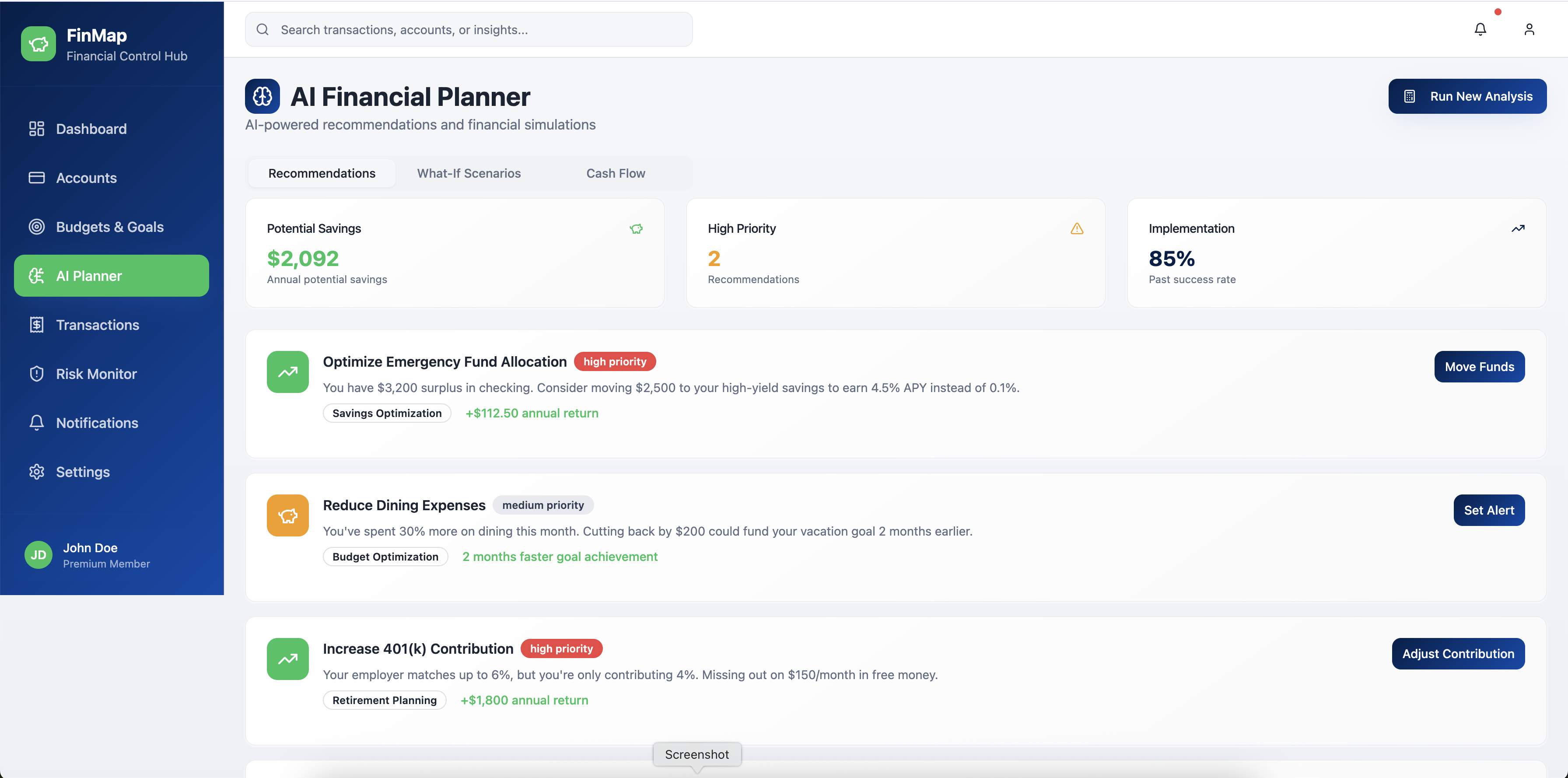

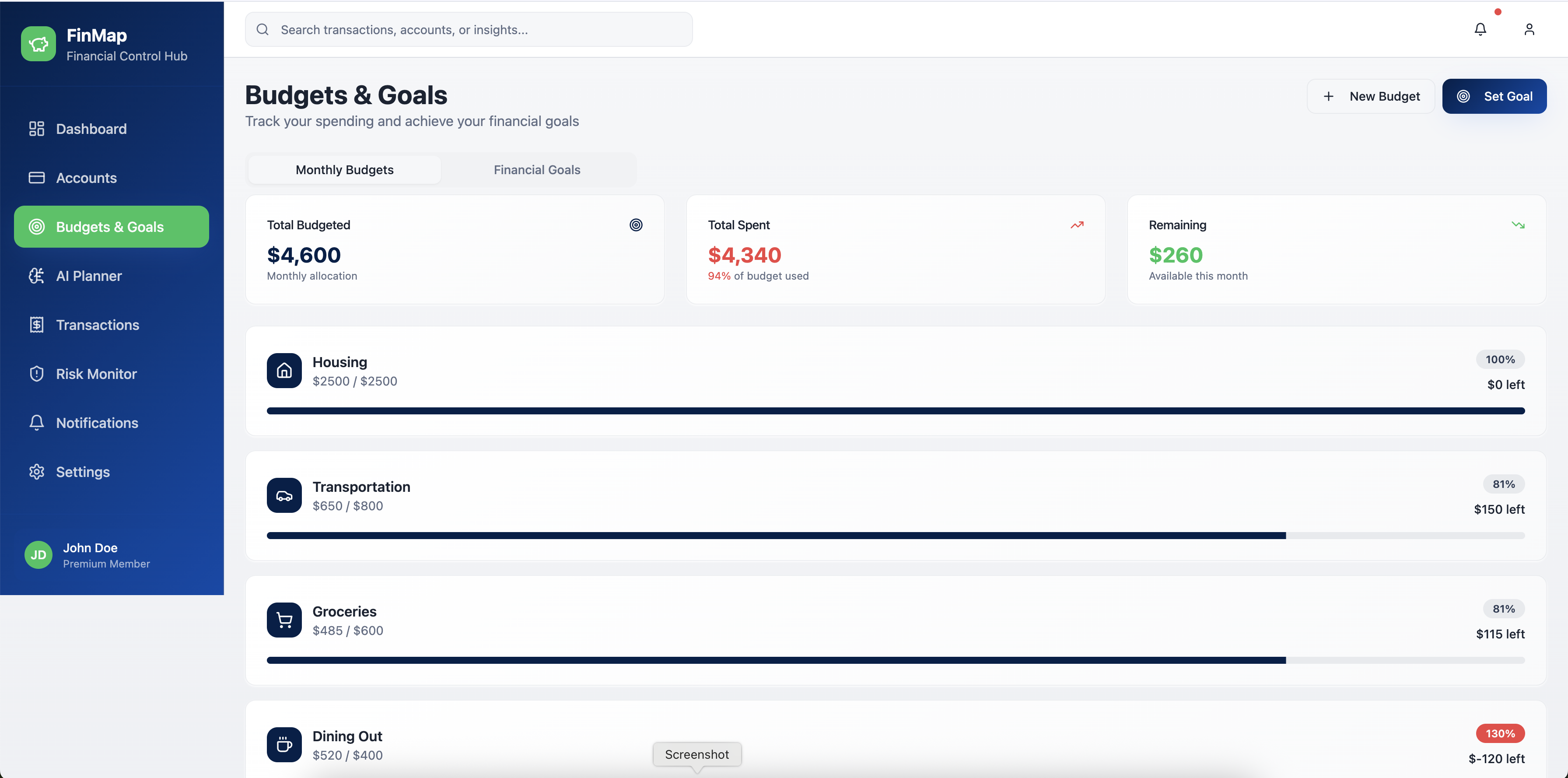

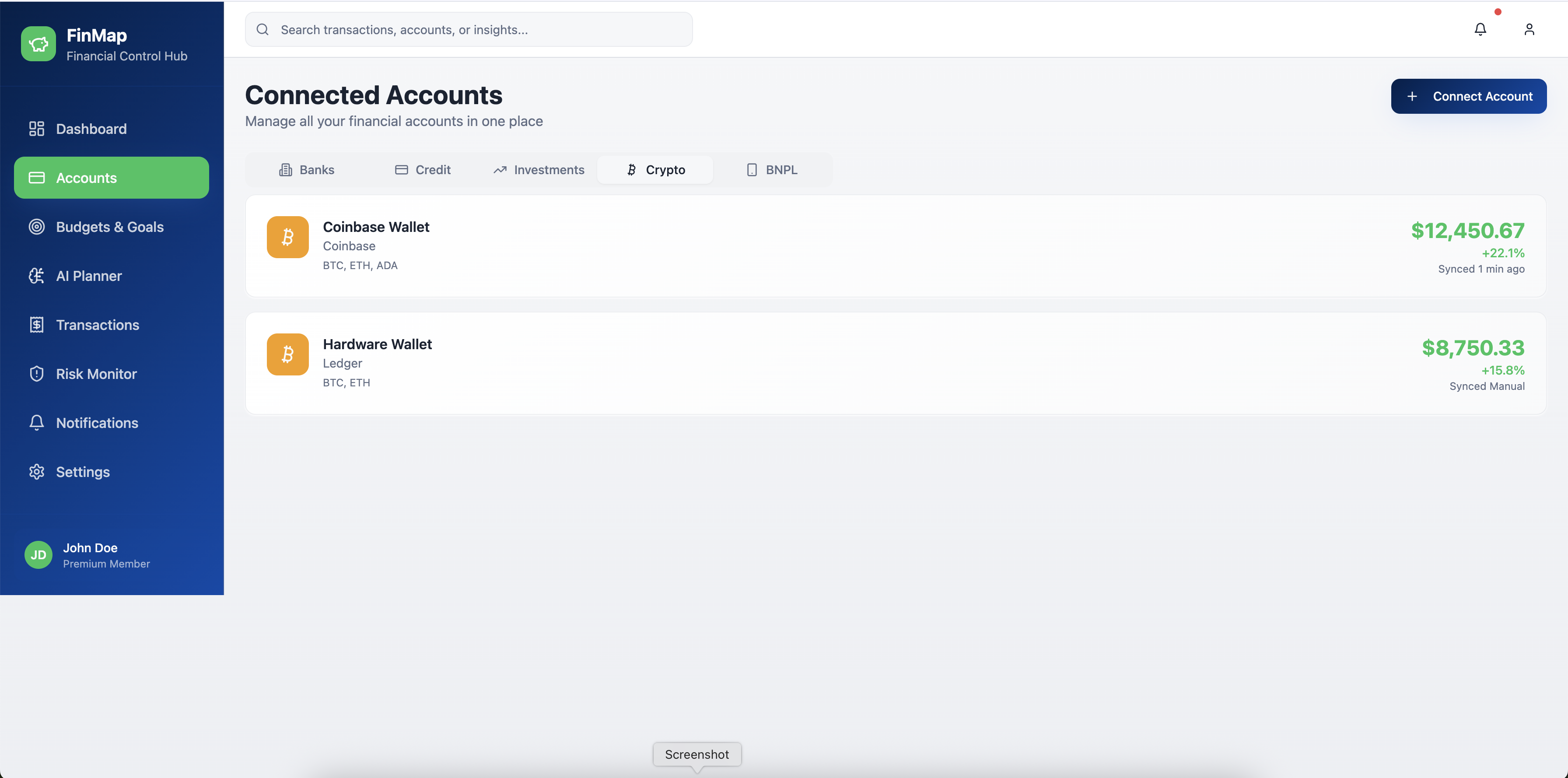

FinMap is an intelligent financial management platform designed for individuals juggling multiple financial accounts and goals. It empowers users to gain total visibility across banking, credit, investments, crypto, and insurance — and leverages AI to deliver actionable insights that improve financial health over time.

FinMap solves the problem of financial fragmentation and decision paralysis in today’s complex money ecosystem. Users connect all their accounts through a seamless onboarding process, set their savings or lifestyle goals, and get AI-powered financial recommendations daily. I led the product definition and experience design — from initial market validation and competitive analysis to user journey mapping and core interaction design. I collaborated with engineers, data scientists, and compliance leads to define secure account integrations, insight logic, and personalized dashboard modules.

Modern users manage finances across dozens of platforms (banks, wallets, cards, BNPL, crypto, pension plans) — but lack a unified control panel to manage, understand, and optimize it. Traditional budgeting apps only track spend but don’t provide guidance or intelligent automation. Our challenge: Build a dynamic, AI-first dashboard that simplifies complex finances, nudges users toward better habits, and respects data privacy.

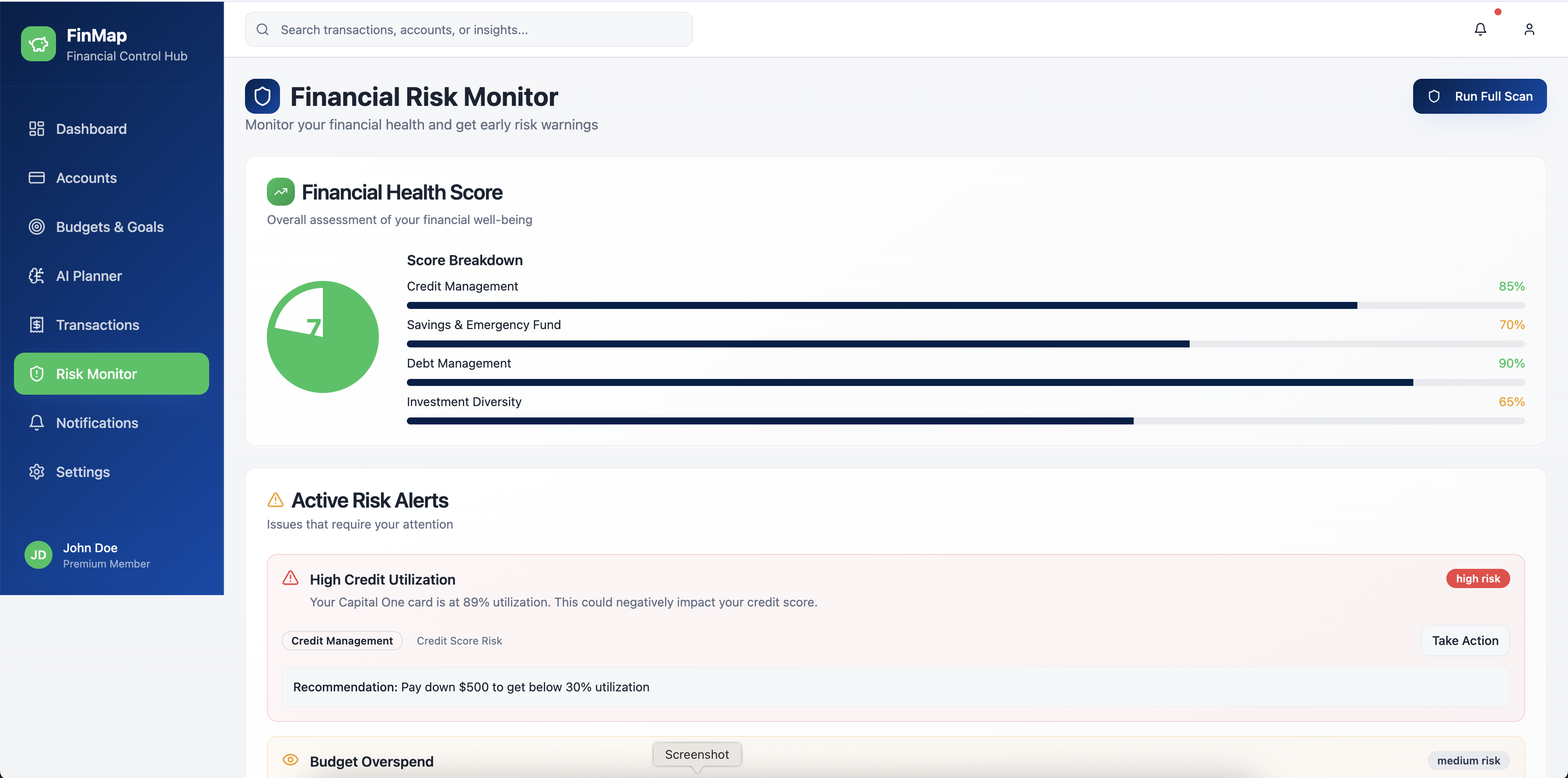

A proactive, personalized platform with a single goal: help users make smarter money decisions every day. FinMap aggregates financial data, analyzes trends, and provides real-time insights and actionable suggestions — from reducing high-interest debt to investing unutilized funds. It encourages habit formation through challenges, financial health scores, and risk alerts.

Key Features

- Universal Account Aggregation (Banking, Credit, BNPL, Crypto, Insurance)

- AI-Powered Financial Planner (Daily money suggestions based on real behavior)

- Dynamic Net Worth & Cash Flow Dashboards

- Risk Radar (Detects financial stress, overspending, or poor diversification)

- Goal Automation Engine (Auto-fund savings, debt paydown, investments)

- Challenges & Missions (Gamified financial habits)

- Smart Notifications & Financial Calendar

- Secure Syncing + Privacy-First Design